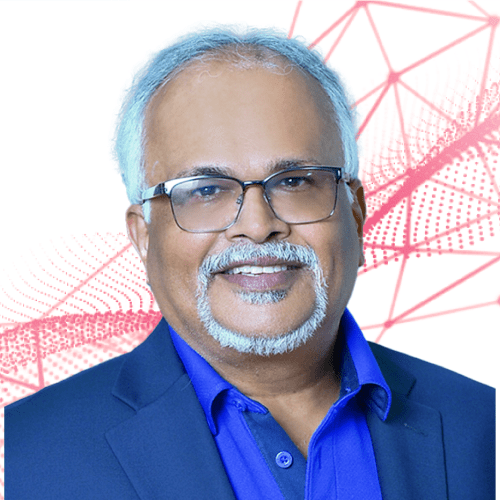

Senior legal counsel, Revolut

Biography:

Konstantinos Adamos works in fintech advising on complex regulatory matters, domestic and cross-border expansion, governance, regulatory licensing & regulatory engagement, as well as product launch and structuring. His main focus is translating technical requirements into actionable business-oriented advice that enables his clients to easily navigate the regulatory landscape and achieve their business objectives.

Konstantinos focus areas are primarily:

– crypto (FSMA, RAO & MLR perimeter issues)

– regulatory authorizations (MiFID, VASP) and change of control/variation of permissions

– FCA handbook compliance

– MiFID (conduct of business, governance and organizational requirements)

– Banking (capital regulation and SMCR)

– Outsourcing arrangements and corporate reorganization

– Electronic money, safeguarding, and payment services

– Insurance

Presentation title:

The impacts of European Crypto-Assets regulation (MiCA) on the global economy

Presentation abstract:

The Markets in Crypto-assets regulation (MiCA) have finally become a reality following its approval by the European Council on October 5, 2022.

Being the first attempt globally at comprehensive regulation of cryptocurrency markets, MiCA extends to money laundering, consumer protection, the accountability of crypto companies, and environmental impact, and also covers several key areas including transparency, disclosure, authorization, and supervision of transactions.

This makes the European Union a pioneer in digital regulation, and the breadth of MiCA means that it will have a significant global impact.

The MiCA has passed through all the stages of the EU’s legislative process, except for approval in the European Parliament, and if that happens, MiCA will come into effect in 2024.